- Profit Strategy: Wholesale

- Number of Units: 6

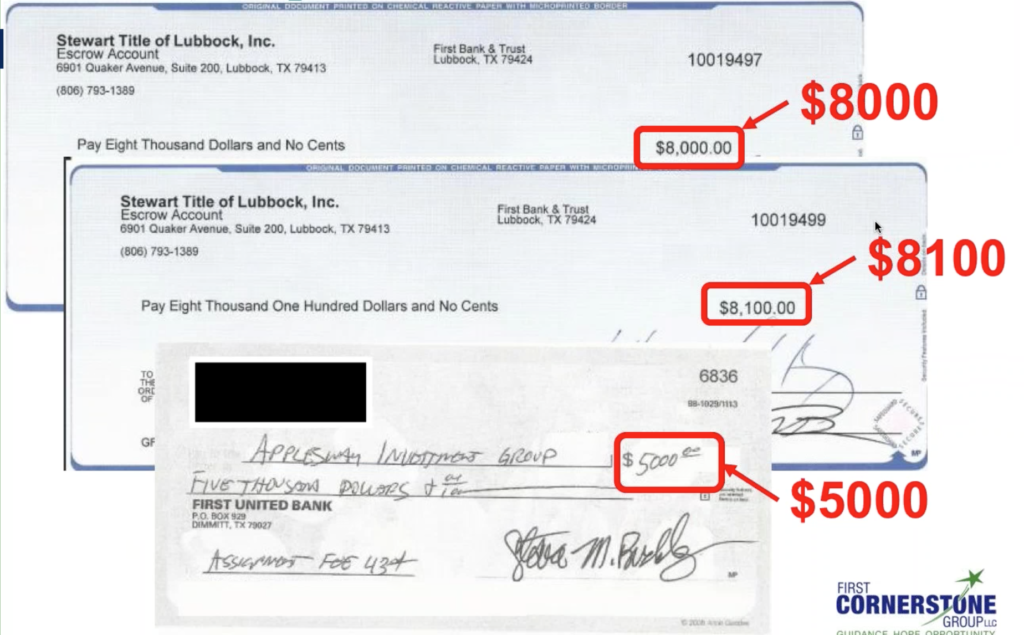

- Amount Earned: $13,674 assignment fee

- Prior Experience: Has been investing for years, mostly buying & selling single family homes in California and Texas, however, had typically steered away from multifamily.

Uncategorized

Joe Fertal

- Profit Strategy: Wholesale

- Number of Units: 5

- Personal Money Invested: $32,000

- Prior Experience: Flipped and rehabbed single family home in 2014

Ed Register

Steve Crow Jr.

- Profit Strategy: Wholesale

- Number of Units: 10

- Amount Earned: $10,000 assignment ($3,000 paid in advance)

- Prior Experience: Some residential. This is his first multifamily deal.

“I am grateful to Lance and his team this would have possibly taken me forever to learn on my own. I am now on my way to doing many more and much larger deals!”

Michael Perry & Julie Kacin

- Profit Strategy: Wholesale

- Number of Units: 40

- Amount Earned: $47,500 total ($20,000 up front + 11 monthly payments of $2,500/mo)

- Prior Experience: While Julie was fairly new to real estate and Michael had experience in houses, this was their first apartment deal.

- Personal Money Invested: $0

Jay Rao Gajavelli 1

Arleen & Dennis Severino

Quick Facts:

- Profit Strategy: Buy & hold

- Number of Units: Triplex

- Amount Earned: $1800 monthly cash flow (with another unit, 2 garages and 12 parking spaces still available to rent out). They estimate each garage can rent for $150/month and parking spot for $50-$75/mo which could bring in an extra $1200/mo total!

- Personal Money Invested: $30,000

- Prior Experience: Purchased a couple of houses in the past and had some experience with single family homes.

Married now for 45 years, Arleen and Dennis Severino raised six amazing children and are now classic empty nesters. Like many healthy active people their age, the New Jersey based couple enjoy activities like playing tennis, hiking, going salsa or swing dancing (and many other forms, depending on their mood) traveling (including visits to their kids out in Colorado and Montana) and spending time with their grandchildren. Though they’ve long left the business and corporate worlds behind, don’t get the idea that they’re anywhere close to retiring. In the wake of their experience with Lance Edwards’ training, they’re also constantly on the hunt for great small apartment deals.

The couple, who began investing in single family homes and small apartments in “C” and “D” areas outside of NYC in 2008, enjoy an extraordinary complementary relationship. The two function as the perfect “tag team,” with Arleen finding the deals and having a “bubbling” effect on people that creates a dynamic introduction, which paves the way for Dennis to follow up with the brass tacks details of deal making. Dennis says Arleen is the “driving force who won’t let moss grow under my feet,” while Arleen calls her husband “the math guy who takes care of the buildings. He’s also great at record keeping.” Dennis owned a construction business until the late 80s, while Arleen worked in sales and marketing for Xerox.

Both enjoy the freedom of working together from home and sharing their real estate adventures together. “I really find the daily MLS hunt online exciting and going out to look at properties a lot of fun,” she says.

“As a home builder,” Dennis adds, “I was always holding a big investment that was subject to the movement of the market. If it moves up, you’re a big winner, and if it goes down, you’re a loser. It takes about a year and a half to build a home and there’s high risk and financial uncertainty during that time. With rentals, it’s more stable because your income isn’t subject to outside market forces. I find it easier to work in the real estate scenario and have to worry less about employee paychecks and more about keeping my tenants happy.”

The 90 Day Challenge winners originally met Lance at a Ron LeGrand summit and were excited about purchasing his course. After working through Lance’s home study, they saw the larger potential of higher cash flow in small apartments through a buy and hold strategy. “We thought Lance was very sharp,” Dennis says, “and we felt he filled an important gap in the small apartment market. Some years ago when the market dropped, some of the investing experts like David Lindahl were talking about buying 100 unit apartments. Lance is more in the lane of those who want to move ahead with small apartments on a medium ground. He also pushed us on how to successfully secure private lending. We had done that in the past, but only with people we knew. He helped us expand our horizons in that area.”

Motivated by Lance’s challenge to get things going, Arleen found the property and got it under contract. It was a three-family unit and the bank had gone through a previous deal that didn’t go through, so they were pushing to get it closed almost immediately and willing to make a great deal. The original listing was $300,000 but the Severinos offered $80,000. They found a private lender to close the property with 110% financing. After they bought the property, a triplex on Lincoln Avenue in East Orange, NJ, they found a second private lender to loan them $50,000 for renovations. All told, they invested $30,000 of their personal money and secured $138,000 through private lenders. The property generates an $1800 monthly cash flow from tenants.

Uniquely, the property includes two garages and 12 parking spaces. Because the buildings within a block or two have no parking and the township charges people to park on the street, the couple initially considered renting the parking spaces for $50- 75 a month and garages for $150 a month. But with the renovation of that building, coupled with some other properties they purchased in the immediate area, they used all those spaces for those helping them do renovation and construction. Thus far, they have bought six more small apartment properties in the area, ranging from 3-plexes to 4-plexes and 6-plexes. They currently own and manage 35 units.

“The way we like to say it is, ‘After Lance and Lincoln, we were motivated to buy these properties,’” says Dennis. “The three and fours are pretty easy to manage. We’re not going to say that a 100-unit building is difficult to manage – it’s just that the average person, especially someone new to small apartments, won’t buy a building that size. The larger the property, the more potential problems it can have. If a single boiler goes bad, you’re up a creek. We’ve found that anywhere from three to 24 units is the sweet spot for us. We much prefer this size small apartment buildings over single families, because the return on a house is less and subject to those market winds. Single families are best suited for fix and flip scenarios, when you use the profit to raise more capital.”

Despite the Severinos’ many years in real estate investing and the accelerated pace of acquisition since studying Lance’s course, Dennis admits that fresh challenges arise every time he and Arleen find a new property to potentially buy. “For us the two major steps are putting in the offer and signing a contract, but every seller is different and you have to be prepared for a different level of negotiations and other issues each time out,” he says. “I think we have done very well, and that motivates us to keep going, but the truth is, there’s always hesitation to make that step when you are not sure what your next step is.

“The second most difficult part is, of course, once your offer is accepted, where do you get the money from?” Dennis adds. “We don’t always have the answer for that either. Yet somehow the answer seems to appear when you take the leap of faith and jump in. We’re lucky to use two or three lenders consistently who are happy to work with us. When you have a history of good cash flow, money is a bit easier to come by.”

Arleen says the different challenges that arise are part of the fun of small apartment investing. “Dennis and I are truly knowledge sponges and we try to learn everything we can as issues arise,” she says. “There are only so many hours in the day, but we are always willing to take chances and be open to change and surprises. Looking for new places, putting deals together, finding private funding – it’s all very exciting for both of us. Perhaps the nicest part that people find a bit unusual is the fact that unlike most building owners, we actually enjoy our tenants.”

Scott McLain

- Number of Units: 3

- Prior Experience: Family involved in R/E for 30 years, then got into hard money lending. From there, he went to an event hosted by Ron LeGrand where he met Lance in a breakout session who opened his eyes to apartments.

- Profit Strategy: Wholesale

- Amount Earned: Bought for $62,500 and sold for $85,000

- Personal Money Invested: None

Rob Wiseman

- Profit Strategy: Buy, fix up and hold.

- Number of Units: 16

- Amount Earned: equity & 30% commission

- Prior Experience: Was a loan officer in mortgage industry for several years, then got real estate license, focusing on “short sells”. He then began acquiring SFHs needing light renovation, which evolved into properties needing heavy renovation, which then evolved again into new construction.

Henry Serrano 1

Quick Facts:

- Profit Strategy: Got property under contract for $165K and sold to buyer for $181,500, resulting in 10% flip fee ($16,500).

- Number of Units: 3

- Amount Earned: $16,500

- Personal Money Invested: $0

- Prior Experience: Some background with single family, not commercial.

Here’s his story:

Like many of those who find success in small apartment investing via Lance Edwards’ boot camps and other programs, Henry Serrano’s great success in multiple areas of real estate is rooted in single family houses.

While working in the financial services industry for nearly 14 years, the Fresno based real estate entrepreneur joined his brother and dad in a very lucrative side business, rehabbing and flipping some homes while keeping some as monthly rentals. At one point, they had nearly 30 homes, and Henry – tired of dealing with tenant problems – used his proceeds from their eventual sale to venture into buying and flipping vacant land properties all over the country, including Arizona and Florida.

When he happened upon Lance’s “How to Make Big Money in Small Apartments” program, he immediately connected with Lance’s story of finding success marketing to out of state owners. His experience with owner financing in his land deals dovetailed well with Lance’s teachings on working similar deals with small apartments.

“I loved the way Lance simplified everything and helped us break down the numbers,” Henry says. “Having spent years working with single family homes, I was inspired by his belief that with multi-family buildings, you can spend the same amount of time analyzing everything yet come out with more zeros in profit on the end. I joined his mentoring program and found those live weekly calls very helpful.

“I also participated in a live workshop in Houston with 10-12 other students, and was able to learn so much about the process from their experiences,”. That was the key, learning how to run through the process, work with Lance’s system and understand the value of due diligence. Being presented with ‘deal or no deal’ scenarios opened my eyes to what to look for in analyzing deals. I liked the way he explained the value of starting small and making comfortable baby steps dealing with individuals rather than corporations and banks if you started with 100-unit buildings and multi-million dollar deals.”

Getting in on the ground floor of Lance’s training during the recession era of 2009-10 allowed for some unique foreclosure-fueled investment opportunities that might not have presented themselves in better economic times. In Henry’s “own backyard,” he connected through one of his leads with an association of homeowners of approximately 40 triplexes, close to half of which were in foreclosure. He focused on a single triplex that had a note on it that was close to $260,000. Henry offered $140,000 and the bank declined it and countered at $160,000.

The basics were that he got the property under contract for $165,000 and sold to the buyer for $181,000, resulting in a 10% wholesale (flip) fee ($16,500), with zero personal money invested. To convince his local investor to pull the trigger, he ran through the numbers. The average unit rented for $850 a month, resulting in a total of over $2400 per month, minus the $200 association fee. That investor also became the end buyer, and the deal closed in 45 days.

One of Lance’s key concepts – the notion of “peas in a pod” – inspired Henry to use that deal as a powerful springboard to many more wholesale deals – nine in all. After going through a playful and elaborate explanation of the way pea pods are designed, he says, “We had a complex with 40 ‘peas’, or triplexes, and my investors and I ended up picking up many of those peas. I knew if there were 20 units ripe for buying and flipping, I could work deals for some of them. It got easier as it went along and became something of a ‘repeat and rinse’ process with the non-owner-occupied units. Even though I was fast building a portfolio, there was still this smaller feel about each property that worked.”

Henry’s desire to stay away from the landlord realm and continue to wholesale led him to much larger deals where he served as “matchmaker” between investors and buyers – including one where he earned a $25,000 commission on a $5 million dollar deal. He’s found that in recent years, the market is more challenging than it was during the darker days of the Great Recession. While he’s still involved from time to time in four and eightplexes, he’s often looking for situations where tax delinquency, divorce, death or financial hardship open up more streamlined opportunities to wholesale.

This multi-faceted success and Henry’s ongoing desire to find properties, connect people and make deals inspired him to emulate Lance in another way. Eight years ago, as an extension of his matchmaking endeavors, he created a local Fresno area real estate Meetup group to provide networking opportunities and a support system for local investors. Meeting on average of once a month, the community – which boasts a total of 500 overall members and 20-30 who meet regularly – has several different subgroups related to matchmaking and wholesaling. He proudly points to the incredible breakthrough success of one member, a copy machine salesman who knew nothing about real estate coming in and now owns over 44 rental units.

“I love helping and educating people, and paying my success forward so that others may enjoy success in this challenging business,” Henry says. “I find that teaching lends me credibility because people look at the person running the group as one with authority. But the most important part of this group is the networking and leveraging possibilities. Instead of me having to do mailings and look for sellers on my own, I have an incredible pool of people who already have investments and who can bring opportunities to me. I have such fond memories of Lance’s weekly support meetings, and likewise, my group is a place where people can feel free to go over any issues, discuss their struggles and work on solutions in a judgement free environment.”

As someone who once toiled in a corporate setting, Henry is thrilled that his success as an independent investor and matchmaker have given him a flexible schedule that has allowed him to spend time with his 18 and 13-year-old daughters. Since his older one is currently attending the University of Kentucky, these days that includes the opportunity to get on a plane and share a football game at the school with her. He remembers being inspired when Lance told him that one of his motivations was having enough money to send his daughter to whatever college she wanted to apply to. Now, Henry is living that “dad dream” himself.

Ever the entrepreneur, Henry also currently has a safety training business, which he purchased from a friend during the depth of the recession. Once a half million dollar a year business, Henry has restored it to its former success and grown it significantly.

“My whole family has always been entrepreneurial,” he says, “and with both this business and my real estate endeavors, the reward is the enjoyment I get in having that flexibility to get up and go when I want. Time and freedom are everything. I’ve found that the key to being successful in this business is consistency. You’re going to have good days and bad days, but you have to commit the daily, weekly and monthly effort. We live in an era of instant gratification, but in this world, results are all about taking the time and putting in the work.”